Digital World

Infographic: AI Research and Development in the U.S., EU and China

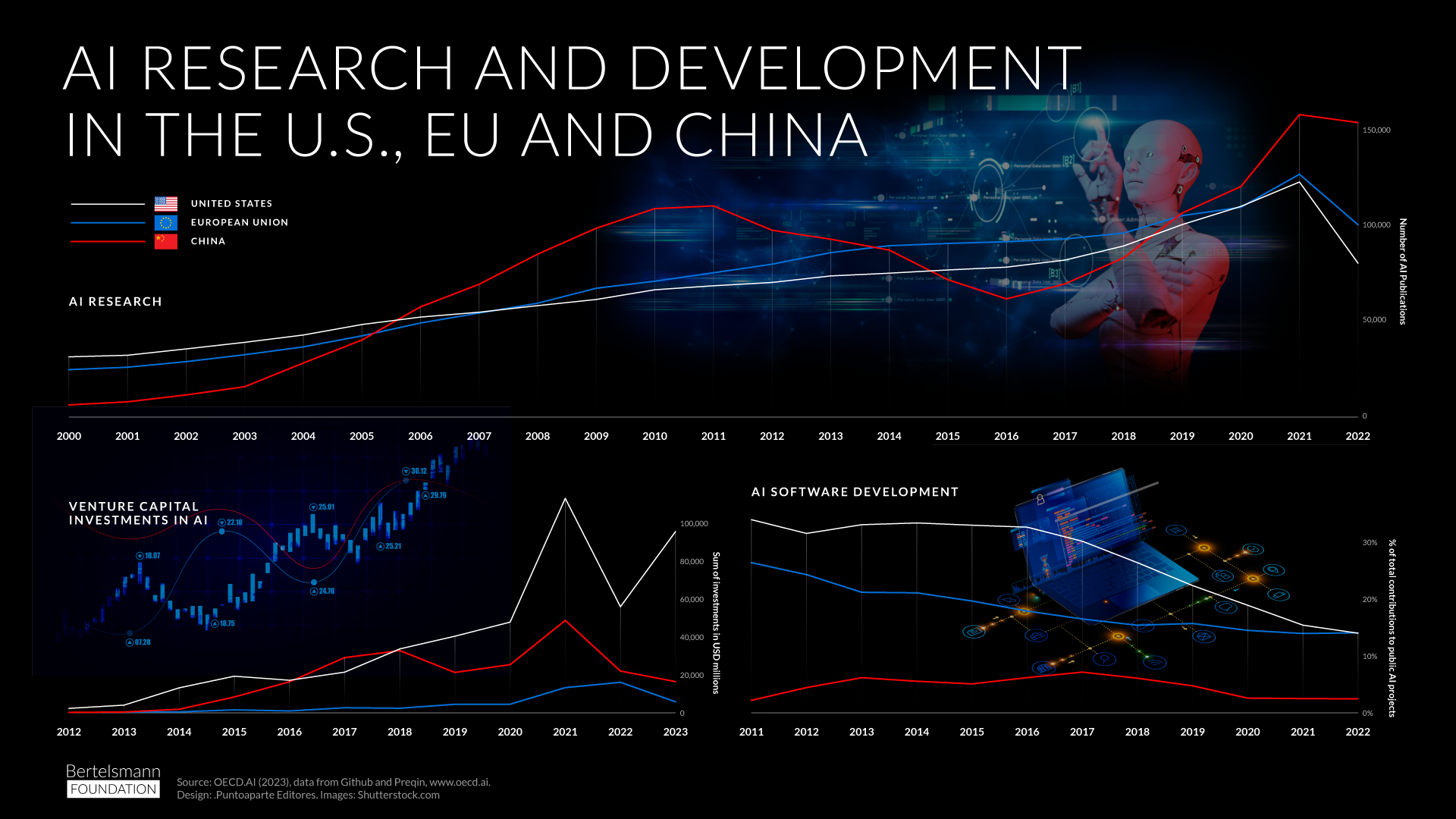

As governments and the general public pay closer attention to artificial intelligence (AI) and options for its regulation, we examine U.S., EU and Chinese progress on AI research and development over the last two decades.

AI Research

The U.S. was a leader in AI research in the early 2000s. Its institutions published more AI-related papers than those in any other country. But in 2006, China took the lead as the source of 58,067 AI publications. The U.S. and the EU trailed with, respectively, 52,671 and 49,540. Chinese researchers have since become even more prolific, publishing 155,487 AI papers in 2022, followed by those in the EU with 101,455 and U.S. researchers’ 81,130. The Chinese accounted for nearly 40% of global AI publications in 2021.

In the 2010s, while China’s technology industry was still developing, U.S. researchers argued that China’s lead in volume of papers did not erase the quality of its research and AI talent. The talent gap continues, as more than half of the best Chinese AI scientists work or pursue graduate degrees outside their country, but the quality of China’s AI research papers has improved significantly over the years. A study from Nikkei Asia measuring the quality of AI research by counting the number of papers in the top 10% of citations in other papers shows that China overtook the U.S. in the quality of its AI research by 2019. By 2021, China accounted for 7,401 of the most-cited papers, 70% more than the number of the most-cited U.S. papers.

American technology companies continue to dominate the AI research space with six corporate giants, including Google, Microsoft and IBM, among the top 10 producers of the most-cited research. Chinese companies are gaining traction, however. Only one company was in the top 10 in 2012; there were four in 2021. Tencent, Alibaba and Huawei have forged ahead in the number of AI papers that they produce and the citations that these publications receive.

Venture Capital Investment in AI

The U.S. continues to lead in attracting the most venture capital investment in AI and data startups, scoring a sharp increase between 2020 and 2021. The bulk of this investment was in mobility and autonomous vehicles (AV), healthcare and biotechnology, and business processes and support services. Investment growth in healthcare and biotechnology is likely a result of the COVID-19 pandemic, as is the growth seen in business services since many workers and students transitioned to hybrid or remote arrangements with the help of platforms like Zoom and Microsoft Teams. Investment in these sectors, however, decreased significantly in 2022 and 2023, and replaced by the $25 billion that is expected to flow into AI-powered marketing on social media platforms in 2023. Financial and insurance services is expected to be the second biggest industry for venture capital investment in 2023 at almost $15 billion.

The EU and China saw a similar trend to that in the U.S. The EU sectors that attracted the most venture capital investment between 2020 and 2022 were business processes and financial and insurance services. The top sector for 2023 is expected to be IT infrastructure, drawing almost $1.5 billion, followed by AI in social media marketing at almost $1 billion, even if both are significantly less than that seen in the U.S. In China, the AV industry has seen a stark increase in investment since 2018. It continues to be the sector attracting the most venture capital there, even if the amount was much lower in 2023 than in 2021. China’s second-biggest sector for such investment in 2021 was robots, sensors and IT hardware, which brought in $10 billion. The figure for 2023 is expected to show a decline to $2 billion.

AI Software Development

The U.S. and EU are ahead of China in AI software development, though not significantly. As the U.S. and EU gradually decrease their contributions to AI software development, the gap with China is closing. This trend is reflected in the software development contributions made to public AI projects by American, European and Chinese developers on GitHub, a platform and cloud-based service for software development and version control. GitHub is the primary platform for developers to store and manage their code and to collaborate.

The Organization for Economic Co-operation and Development (OECD) collects data on the number of GitHub’s AI projects, or AI-related GitHub repositories, and developer contributions made to these projects. Analysis of that data allows identifying AI software developers, their locations, the development tools they use and the level of impact of their AI projects. All this provides insight into the broader trends in software development and innovation. Level of impact is determined by the number of managed copies, or forks, that other developers make of a given AI project. By this measure, U.S. and EU high-impact AI projects declined from 40% and 26% respectively in 2011 to 20% and 16% in 2022. In the same period, the number of high-impact Chinese AI software projects grew from almost 0% to 11.6% in 2022.